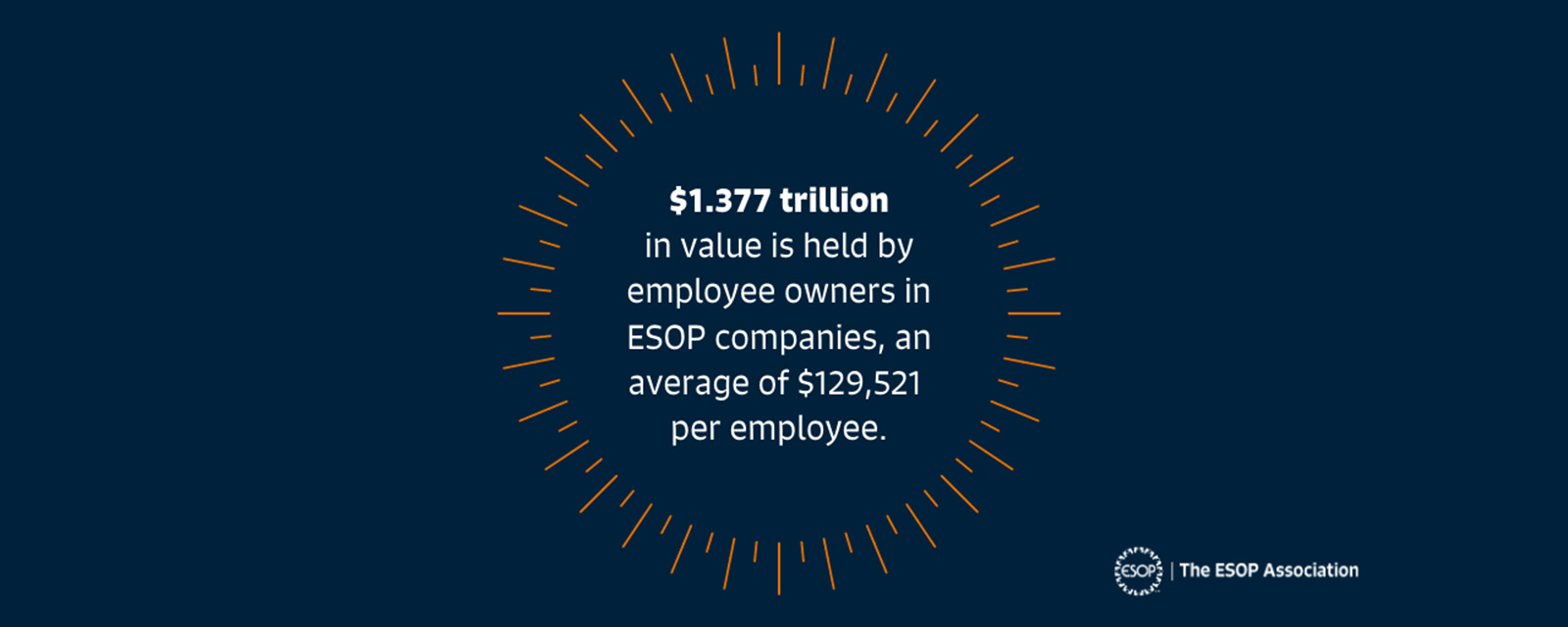

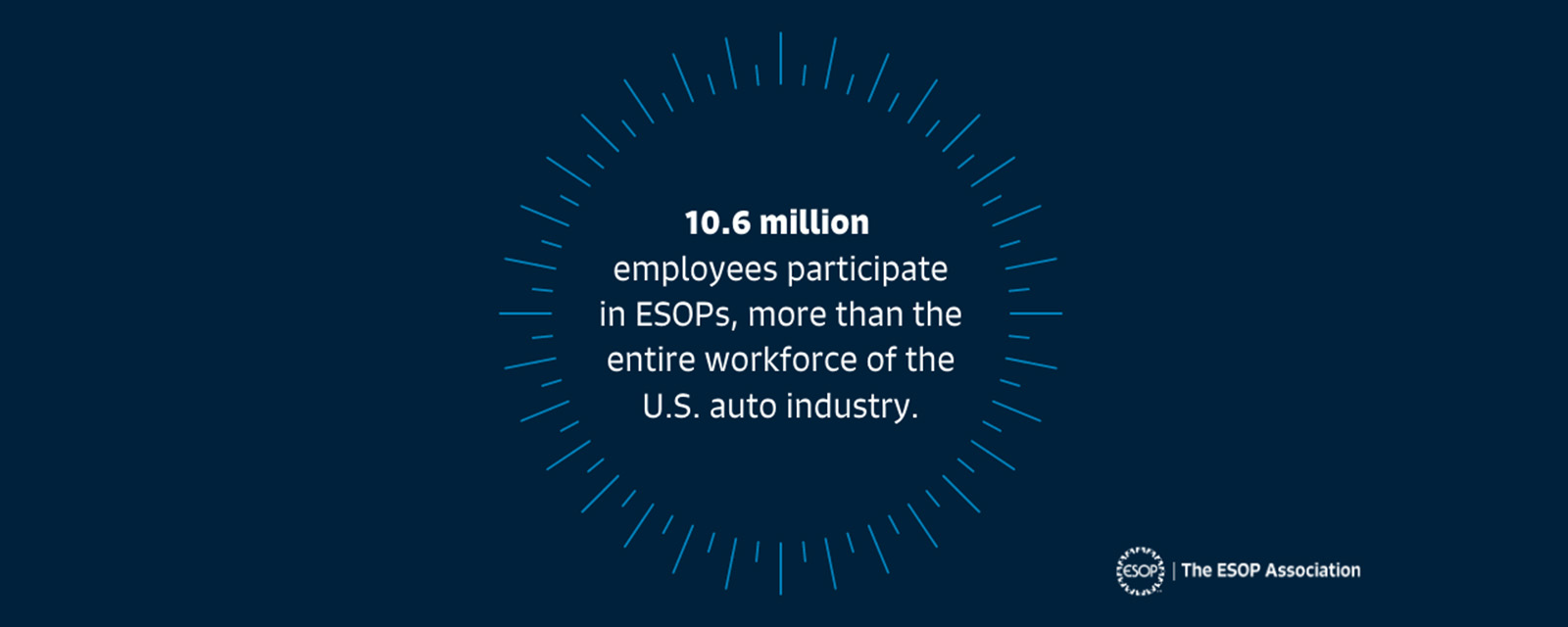

Caltrol employees are employee owners, meaning they own “Shares” in the company held in individual accounts. The amount of shares held by an employee is determined by their pay. As the company increases in value, employee shares increase in value too. On the other hand, if the value of the company decreases, then employee shares may also fall in value.

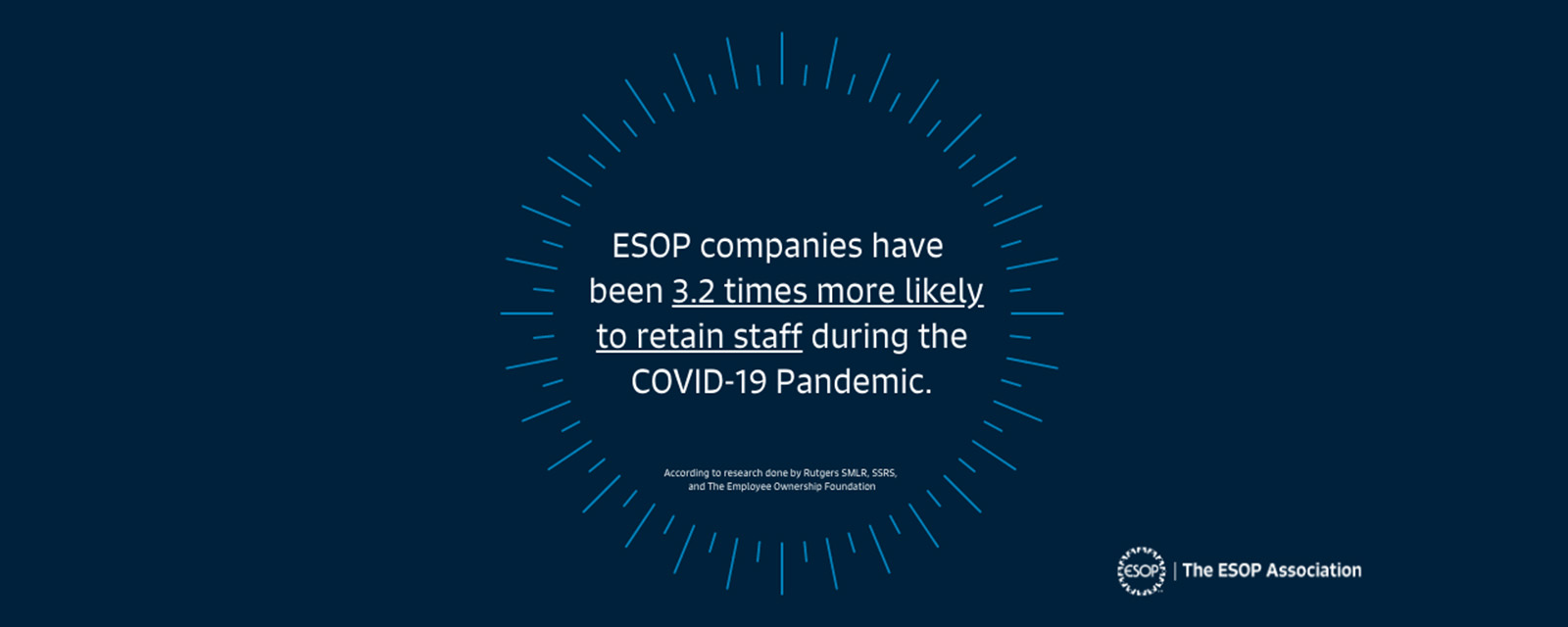

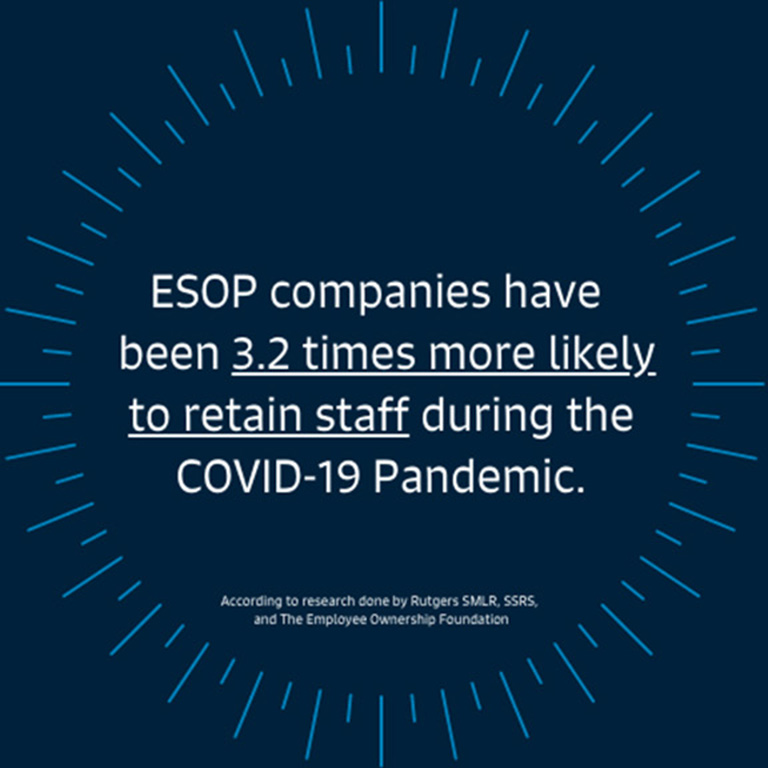

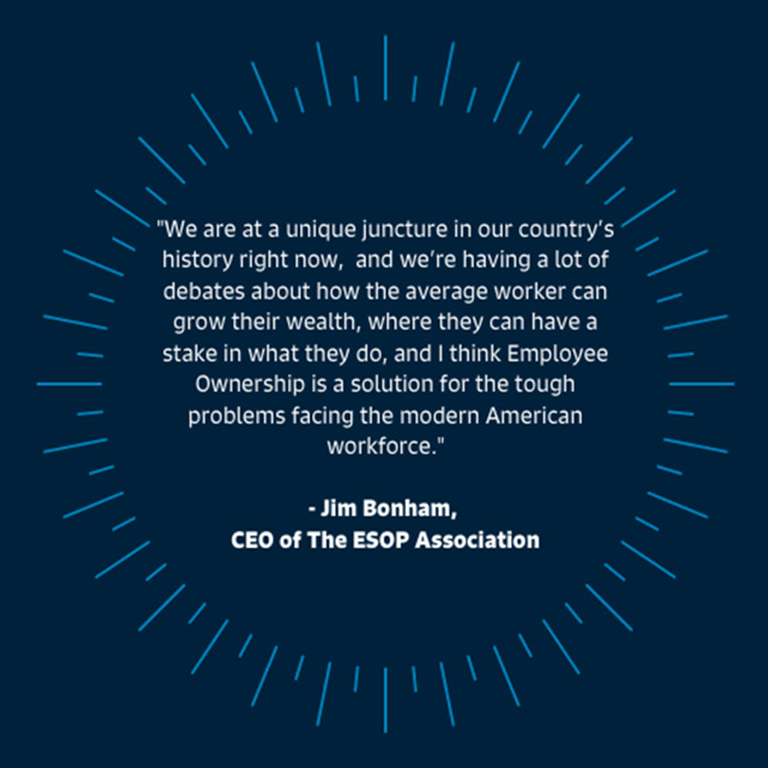

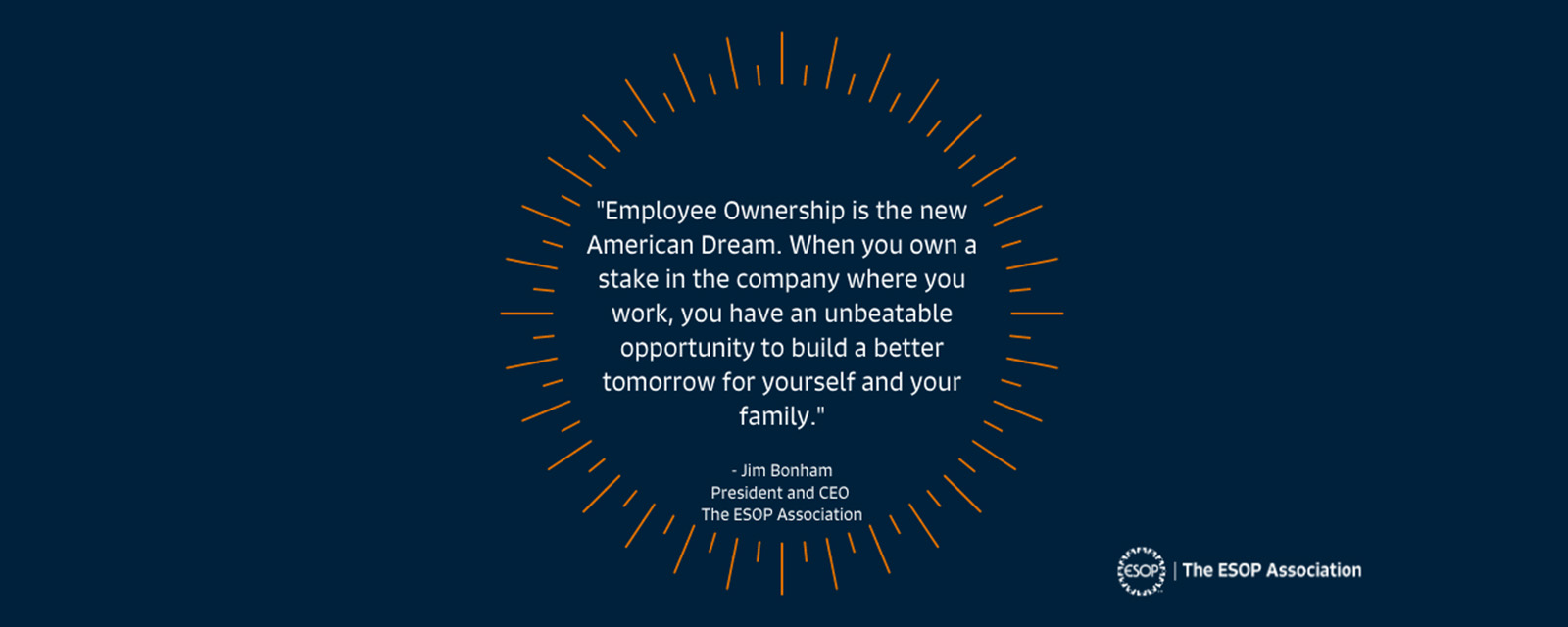

As an employee owner you have a greater stake in the company and a greater opportunity to reap rewards of ownership.

As an employee owner you have a greater stake in the company and a greater opportunity to reap rewards of ownership.